A healthcare emergency may come slamming from the your home when good people the very least wants it. Many folks prepare for they by buying medical care insurance, quite often, these regulations you should never shelter most of the regions of a medical costs. Things eg ineffective sum insured, a criticism not receiving shielded under the policy, otherwise a hospital not listed on the committee out of insurer’s TPA (Alternative party Administrator), can obstruct an individual’s requisite procedures. A rapid demand for including nature could have you running around asking for financial help from friends and family. In such cases, a choice way to obtain financing such a personal bank loan will come to your services. Is everything you need to understand unsecured loans and you can why you should grab her or him in case there is a healthcare crisis.

A personal bank loan to have a medical crisis try a quick mortgage business that you could simply take through the an overall economy such as a beneficial medical crisis. Of numerous banking institutions and you can NBFCs (Non-Banking Monetary Enterprises) promote that it disaster loan getting heavier scientific expense, consultation costs, diagnostics, an such like.

Listed below are some Trick Benefits of Delivering a consumer loan getting Scientific Emergencies:

? Quick Processing: Respected loan providers see the necessity of a medical crisis, and so they give an entire digitized software techniques with just minimal documents, hence letting you discover finance rapidly . That loan for a health emergency is approved rapidly and you can paid right to a beneficial borrower’s account in one day or a couple of, otherwise sometimes even fundamentally. Yet not, it is vital that consumers meet with the eligibility criteria.

? Zero equity: As this is a keen unsecured disaster loan you don’t have to worry about pledging guarantee or defense for this financing.

? Large amount of mortgage: One can use around INR twenty five lakhs* because a personal bank loan to possess a health disaster to fulfil the scientific standards easily.

? Cures everywhere: You are able to which loan amount in virtually any health or individual cures center getting purchasing debts, diagnostics, an such like.

? Method of getting the medical facilities: In the place of health care insurance principles where only limited conditions or tips score secured, al categories of procedures try possible which have a healthcare disaster loan.

? Attractive Rates: Certain credit institutions promote glamorous interest rates to help you consumers with a high eligibility. Your own qualification getting a personal loan very depends on your revenue, age, credit rating, fees facility or other items. Financial institutions particularly Fullerton India keeps streamlined qualification conditions and online software procedure that will assist you to inside rewarding your scientific financing criteria effortlessly.

? Quick Money: As the verification and you will document research process has been complete effectively, the lending company tend to approve your loan, once you becomes the mortgage number.

? Versatile Payment: Get back the medical crisis loan which have Equated Month-to-month Instalments (EMIs). For most Banking institutions NBFCs, the product quality payment several months is actually anywhere between twelve so you can 60 weeks.

EMI Data to own Medical Mortgage:

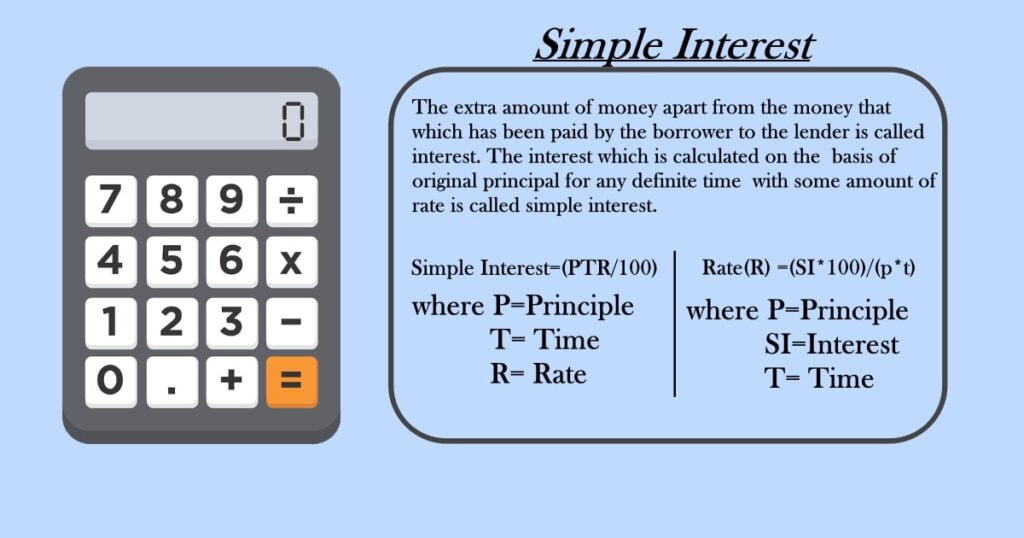

Equated Month-to-month Instalment ‘s the count one to a borrower pays all of the day toward financial otherwise NBFC when deciding to take the borrowed funds. It is calculated in accordance with the loan amount, tenure interest rate. Brand new formula to help you assess EMI is actually,

As interest rates are very different for various banks NBFCs, the newest EMI are very different. It is vital that you usually determine your EMI that suits your earnings and you may properly decide best period into scientific mortgage.

Application Techniques to have a healthcare Financing:

? Favor a respected bank whose unsecured loan qualification criteria suits their character and will be offering the mortgage during the an aggressive rate of interest. Select the maximum amount borrowed you desire into the treatment of the checking the most you are qualified to receive using good personal bank loan eligibility calculator.

? To utilize, go to the lender’s web site or down load their cellular application. Register the cellular matter with OTP confirmation to begin their trip

? Once your documents and you may verification techniques try efficiently accomplished, brand new recognized money would-be paid into checking account.

A personal loan are a benefit, especially in problems. The brand new easy and quick approval procedure, minimal documents and you can quick disbursal can be a lifesaver. Thus next time https://www.clickcashadvance.com/installment-loans-il/cleveland you otherwise your beloved you desire medical treatment and you ought to arrange small loans, you might choose to apply for an unsecured loan.