The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle. As you can see, no matter what the transaction is, the accounting equation will always balance because each transaction has a dual aspect.

Obligations owed to other companies and people are considered liabilities and can be categorized as current and long-term liabilities. We can expand the equity component of the formula to include common stock and retained earnings. This transaction affects both sides of the accounting equation; both the left and right sides of the equation increase by +$250.

Arrangement #1: Equity = Assets – Liabilities

While single-entry accounting can help you kickstart your bookkeeping knowledge, it’s a dated process that many other business owners, investors, and banks won’t rely on. That’s why you’re better off starting with double-entry bookkeeping, even if you don’t do much reporting beyond a standard profit and loss statement. Under all circumstances, each transaction must have a dual effect on the accounting transaction. For instance, if an asset increases, there must be a corresponding decrease in another asset or an increase in a specific liability or stockholders’ equity item. In this form, it is easier to highlight the relationship between shareholder’s equity and debt (liabilities). As you can see, shareholder’s equity is the remainder after liabilities have been subtracted from assets.

As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). The business has paid $250 cash (asset) to repay some of the loan (liability) resulting in both the cash and loan liability reducing by $250. Required Explain how each of the above transactions impact the accounting equation mofrad financial solutions and illustrate the cumulative effect that they have.

Example Transaction #8: Payment of Accounts Payable

As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded. The cost of this sale will be the cost of the 10 units of inventory sold which is $250 (10 units x $25). The difference between the $400 income and $250 cost of sales represents a profit of $150. The inventory (asset) will decrease by $250 and a cost of sale (expense) will be recorded. (Note that, as above, the adjustment to the inventory and cost of sales figures may be made at the year-end through an adjustment to the closing stock but has been illustrated below for completeness).

To learn more about the income statement, see Income Statement Outline. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Apple pays for rent ($600) and utilities ($200) expenses for a total of $800 in cash. We use owner’s equity in a sole proprietorship, a business with only one owner, and they are legally liable for anything on a personal level.

While the accounting equation goes hand-in-hand with the balance sheet, it is also a fundamental aspect of the double-entry accounting system. The accounting equation is so fundamental to accounting that it’s often the first concept taught in entry-level courses. It offers a quick, no-frills answer to keeping your assets versus liabilities in balance. It’s important to note that although dividends reduce retained earnings, they are not expenses. Therefore, dividends are excluded when determining net income (revenue – expenses), just like stockholder investments (common and preferred). In accounting, we have different classifications of assets and liabilities because we need to determine how we report them on the balance sheet.

- Owners’ equity typically refers to partnerships (a business owned by two or more individuals).

- At first glance, this may look overwhelming — but don’t worry because all three reveal the same information; it just depends on what kind of information you’re looking for.

- Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs).

- In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations.

Company worth

For example, if a company becomes bankrupt, its assets are sold and these funds are used to settle its debts first. Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investment. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense.

This straightforward relationship between assets, liabilities, and equity is considered to how to develop an aggregate plan for your operations management be the foundation of the double-entry accounting system. The accounting equation ensures that the balance sheet remains balanced. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side.

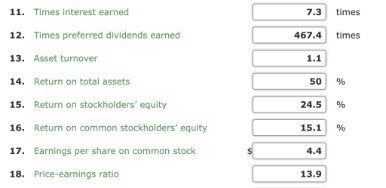

The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets.

We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. The revenue a company shareholder can claim after debts have been paid is Shareholder Equity. Before technological advances came along for these growing businesses, bookkeepers were forced to manually manage their accounting (when single-entry accounting was the norm). Of course, this lead to the chance of human error, which is detrimental to a company’s health, balance sheets, and investor ability. The assets of the business will increase by $12,000 as a result of acquiring the van (asset) but will also decrease by an equal amount due to the payment of cash (asset).

If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more. These are some simple examples, but even the most complicated transactions can be recorded in a similar way.

Non-current assets or liabilities are those that cannot be converted easily into cash, typically within a year, that is. While we mainly discuss only the BS in this article, the IS shows a company’s revenue and expenses and includes net income as the final line. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. $10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid.

Some common examples of tangibles include property, plant and equipment (PP&E), and supplies found in the office. Current assets and liabilities can be converted into cash within one year. Shareholders, or owners of stock, benefit from limited liability because they are not personally liable for any debts or obligations the corporate entity may have as a business. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.