These examples illustrate how contra accounts are used in various contexts to provide a more accurate picture of a company’s financial position and performance. Overall, while maintaining contra accounts may require additional effort, the benefits they offer in terms of financial transparency and accountability make them an essential tool in accounting. Make sure you track each type of contra revenue carefully to maintain precise records that can then inform your business decisions and help you spot trends or issues in sales processes, product quality, or pricing strategies. At Invoiced, we provide a suite of solutions that work together to make managing your invoicing, accounts receivable, and accounts payable seamless and easy. To convert your invoice management efforts to an electronic format that can easily share data with other financial systems, businesses can leverage Invoiced’s E-invoice Network.

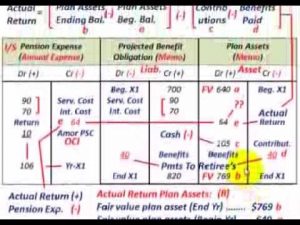

What is the journal entry to record amortization expense?

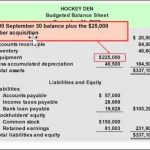

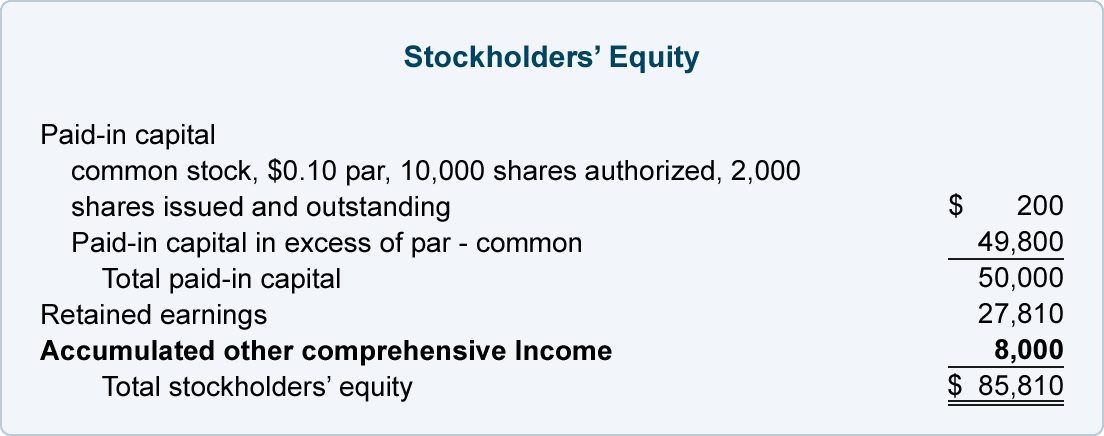

Contra asset accounts are recorded with a credit balance that decreases the balance of an asset. A key example of contra liabilities includes discounts on notes or bonds payable. Accumulated depreciation decreases the value of an asset, bringing it more in line with its market value. When the amount recorded in the contra revenue accounts is subtracted from the amount of gross revenue, it equals the net revenue of a company. In case a customer returns a product, the company will record the financial activity under the sales return account. The use of contra accounts ensures the accuracy of financial accounting records, as the value of the original accounts is not directly reduced.

What is a contra asset?

- Make sure you track each type of contra revenue carefully to maintain precise records that can then inform your business decisions and help you spot trends or issues in sales processes, product quality, or pricing strategies.

- Keep reading to learn more about contra revenue accounts and what should go in them.

- Instead, it is reported at its full amount with an allowance for bad debts listed below it.

- Accounting software can simplify the management of and reporting from your ledger.

- By tracking contra accounts, a company can make more informed decisions about asset management, liability settlement, and overall financial planning.

- Contra revenue affects the income statement by reducing gross sales, ultimately influencing the net sales figure.

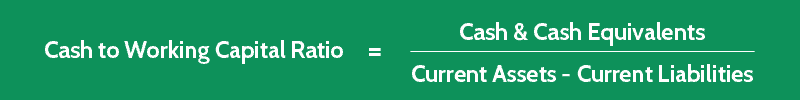

For example, when a line item on your balance sheet presents the balance of accounts receivable, report the value of allowance of uncollectible accounts below the accounts receivable line. Be sure to enter the contra account on the opposite column of the account they’re offsetting. If contra assets appear in the credit column, record contra liabilities on side. Contra revenue refers to deductions from your business’s gross sales, including sales returns, allowances, and discounts. Unlike regular expenses such as rent or salaries, which are the costs of operating your business, contra revenue is directly subtracted from sales revenue on your financial statements.

Types of Contra Accounts

A contra account is an account with a balance opposite the normal accounts in its category. Contra accounts are usually linked to specific accounts on the balance sheet and are reported as subtractions from these accounts. contra expense account In other words, contra accounts are used to reduce normal accounts on the balance sheet. For example, accumulated depreciation is a contra asset that reduces the value of a company’s fixed assets, resulting in net assets.

If your client returns $1000 of the products bought, you record Sales Returns and Allowances worth $1,000 as debit and credit $1000 as Accounts Receivable. Contra accounts provide more detail to accounting figures and improve transparency in financial reporting. When the company pays the cost of having the flyer printed, a journal entry is done.

Contra accounts help maintain the accuracy of financial records, provide transparency in reporting, and allow for proper tracking and analysis of specific transactions or events. A contra account is an account used in a general ledger to reduce the value of a related account when the two are netted together. The term “contra” means “against,” which perfectly describes the role these accounts play in your finances – they are going against the norm. This article will explain what contra revenue is, how to record it accurately, and some effective management strategies. We’ll also touch on related topics like gross vs. net profit, prepaid expenses, and unearned revenue. This general structure can be applied across all contra types, so if the parent account has a credit, the contra account will have a debit.

- A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification.

- The hottest retail item of today can be relegated to nostalgia channels on YouTube tomorrow.

- A contra revenue account allows a company to see the original amount sold and to also see the items that reduced the sales to the amount of net sales.

- If your business makes $100,000 in gross sales, say, and has $5,000 in total contra revenues from returns, allowances, and discounts, your net sales would be reported as $95,000.

- A contra revenue account is a revenue account that is expected to have a debit balance (instead of the usual credit balance).

- The auditors aim to keep the balances at their adequate levels, but the controller might want to keep them as low as possible to reduce expenses and maximize profit levels.

- When considering all of the money currently owed to your business that’s recorded in your Accounts Receivable (A/R) line item as an existing asset, there’s a good chance that not all of those customers are going to pay you back in full.

- Contra revenue transactions are recorded in one or more contra revenue accounts, which usually have a debit balance (as opposed to the credit balance in the typical revenue account).

- Therefore, contra equity accounts have a debit balance to offset their corresponding equity balances.

- Bills payable or notes payable is a liability that is created when a company borrows any specific amount of money.

What are the Different Types of Contra Accounts?