Mortgage Choices and you can Words

Antique financial alternatives is one another repaired-price and adjustable-rates mortgages (ARMs). Individuals can use for fifteen-seasons otherwise 29-seasons mortgage brokers, which is normal because of it style of home loan. Case choices is generally sometime limited, once the home buyers can only just pick eight-season and you will ten-year Hands. Borrowers looking an effective 5-year Case will not to able to obtain a home loan which have those individuals financing terms which have Rocket.

Eligible consumers could probably get funding compliment of authorities-supported loans, plus FHA money. This type of funds is appealing to first-go out homebuyers due to the relatively easy debtor criteria. Skyrocket Financial is additionally a great Va-accepted lender, this could possibly offer Va funds to help you consumers that happen to be energetic or retired service members of the brand new military.

Non-conforming home loans tends to be an alternative too, because the Skyrocket now offers jumbo money having mortgage numbers you to meet or exceed the newest federal government’s compliant mortgage restrictions. Rocket Home loan have not usually given domestic equity fund, but that’s changed as of . The lending company even offers house collateral fund in order to qualified borrowers. Home equity credit lines (HELOCs) are nevertheless off the table, whether or not. In the event that home owners wanted an option approach to experiencing their property collateral, Skyrocket now offers cash-aside refinances, that would wanted consumers to displace the existing home loan that have good another one in the a separate interest rate.

Mortgage Prices, Charge, and you can Coupons

Mortgage cost are continuously shifting on a daily basis-and are generally determined to some extent because of the an excellent borrower’s monetary affairs-so it is hard to say just what rate of interest a borrower biguity may make borrowers ask yourself, Is actually Skyrocket Mortgage a tear-out of? Definitely not; Rocket Financial rates are just like business averages penned per week from the Freddie Mac. Its worthy of noting you to definitely Rocket Financial makes no pledges that consumers becomes a decreased prices featuring its financial support options-in fact they appetite prospective home buyers to appear beyond home loan pricing alone to get the right financial for them.

Rocket Financial wants borrowers and then make a deposit which is at minimum step three per cent of your own home’s cost, but for example a reduced down-payment amount is typically arranged to possess particular mortgage items like FHA loans. When the borrowers lay less than 20 percent of purchase price forward for their downpayment, might more than likely have to pay individual mortgage insurance policies (PMI). So it additional payment you can expect to raise an effective borrower’s payment per month by due to the fact very much like dos per cent.

Though obtaining a mortgage is free, consumers should shell out particular closing costs and other expenditures eg appraisal costs. Predicated on Skyrocket Home loan, settlement costs typically work at from step 3 per cent to six % of your house’s price point, nevertheless the right matter is detailed on the closing data files. Skyrocket Home loan cannot promote promotion deals, but borrowers decrease their interest rates by purchasing mortgage factors. Consumers have to pay 1 percent of their amount borrowed into the change getting a savings area, that will lower their interest rate by as much as 0.25 fee points. Home buyers can also be capable temporarily dump their interest speed to the another type of buy with Rocket’s Inflation Buster provider. Which buy-off system lets eligible individuals to reduce their interest price by 1 percent at the beginning of their residence loan, decreasing their initially monthly obligations.

Software Process

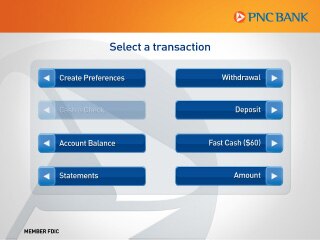

Skyrocket Mortgage https://paydayloanalabama.com/geneva/ offers borrowers three ways to try to get a house loan: on the internet, over the phone, otherwise from the company’s dedicated mobile application. Although this provides a number of options during the software process, consumers who prefer the antique style of making an application for a mortgage-seated that have a loan administrator and working out the details-is generally upset you to hands-to your service could be quite restricted. The online application procedure is quite small, due to the fact providers cards it can easily always be finished in less than 10 minutes. Tourist will have to create an on-line Skyrocket Home loan account to-do the program procedure. Concurrently, possible consumers might be expected add so you can a soft credit eliminate and so the bank is also determine what prices and you can mortgage words they could be eligible for with a new get or refinance. But not, if the home buyers decide to move ahead which have a home loan, Skyrocket will need to would a hard borrowing eliminate when planning on taking a closer look within its cash and you can personal debt.